Palladium prices hit another record high on Tuesday, surging above $1,550 as the threat of strikes by South African mineworkers added to supply concerns in an already tight market, Kommersant reports.

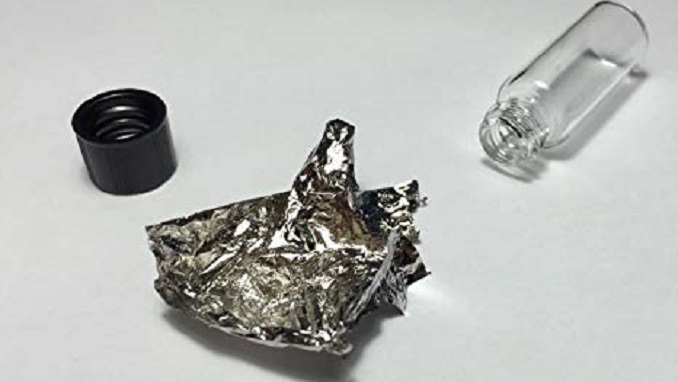

The silvery-white precious metal has risen 21 percent so far this year on a sustained supply deficit. Russia and South Africa are collectively producing about three-quarters of the world’s mined supplies.

“Support comes from supply side issues, mainly from South Africa where a strike by the union has a potential to disrupt output further,” ANZ analyst Daniel Hynes told Reuters, adding that positive news on Sino-U.S. trade is also providing support.

Russia’s output stood at 81 metric tons in 2017, and Norilsk Nickel is the biggest producer of palladium in the world, accounting for almost 40 percent of global production. The company increased its output of the metal by 6 percent in 2017 and is looking to continue growing output amid market concerns about the closure of mines in South Africa.

According to Jim Gallagher, president and CEO of North American Palladium, the automotive industry is going to need more palladium because of tightening emission regulations in Europe and China. “It’s a good time to be a palladium miner,” he said in an interview with Kitco News.

Gallagher noted that future palladium demand all comes down to the European Union’s implementation of Real Driving Emission (RDE) tests.

“For the next three years, you are going to see auto companies just pack the palladium into their converters because they need to get this right. They can’t afford to make any mistakes,” he said. “Once they get the technology right then you might start to see some thrifting but for now I don’t think demand is going to be dropping anytime soon.”

Palladium is used in pollution control devices, electronics, jewelry, groundwater treatment equipment, chemical applications, and dentistry. It has enjoyed a steady upward climb in value over the last decade, starting off at a low of $235 per ounce in November 2008.