Global palladium prices soared to a new record on Tuesday as supply concerns for the autocatalyst metal were driven by the risk of a ban on some Russian exports, Reuters reports.

As of 0642 GMT, spot palladium rose 0.4 percent to $1,589.83 an ounce, after marking an all-time high of $1,593.77 earlier in the session.

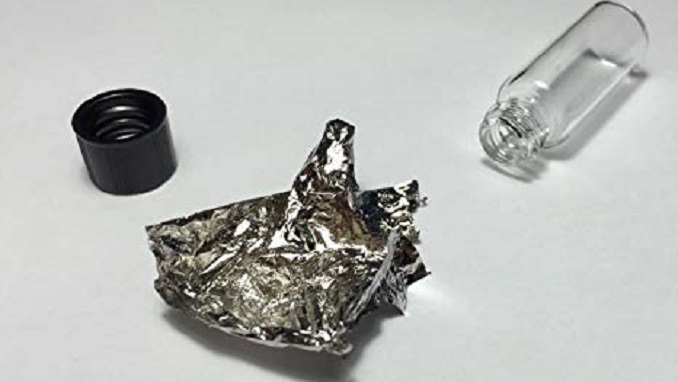

The price of the metal, used mainly in catalytic converters, has nearly doubled since mid-August and is up about 26 percent so far the year.

Russia, a major producer of palladium, is mulling a ban on the export of precious metals scrap and tailings to promote domestic refining of the materials.

“The market is in uncharted territory and on the fundamental side the ban from Russia has supported the prices,” said Ajay Kedia, director at Kedia Commodities in Mumbai.

“Though there are concerns that auto sales are falling, the supply deficit problem is offsetting it,” he said, adding the market is highly overbought.

On the demand side, expectations for more economic stimulus by China, the world’s biggest auto market, could be a short-term driver for the already tight market, said Ilya Spivak, a senior currency strategist at DailyFX.

Meanwhile, spot gold gained 0.3 percent to $1,307.12 per ounce, as the dollar languished near two-week lows hit in the previous session on growing expectations the Fed would shift to a more accommodative policy stance.

U.S. gold futures rose about 0.4 percent to $1,306.70.